- Financials

Quarterly Report For The Financial Period Ended 30 June 2023

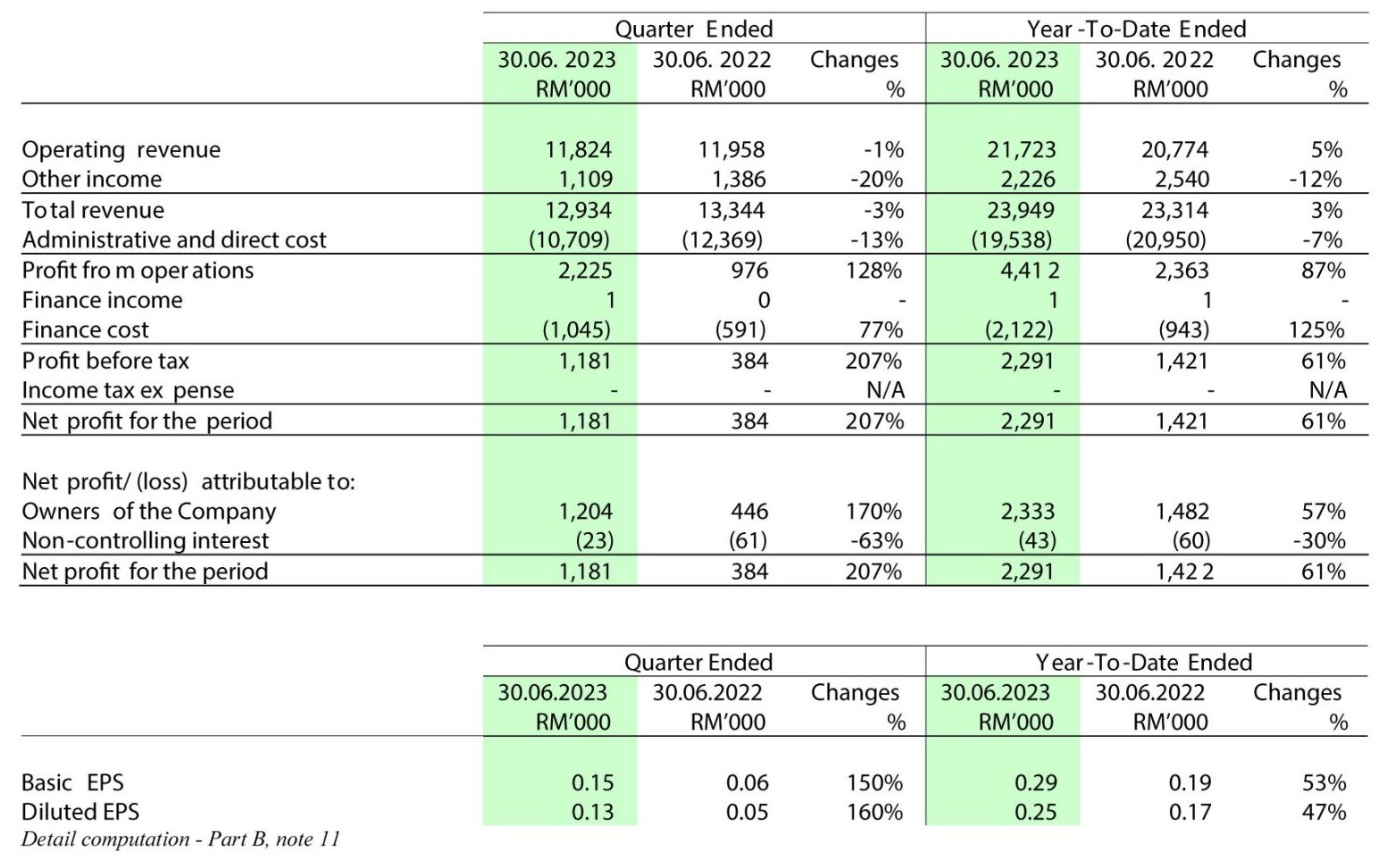

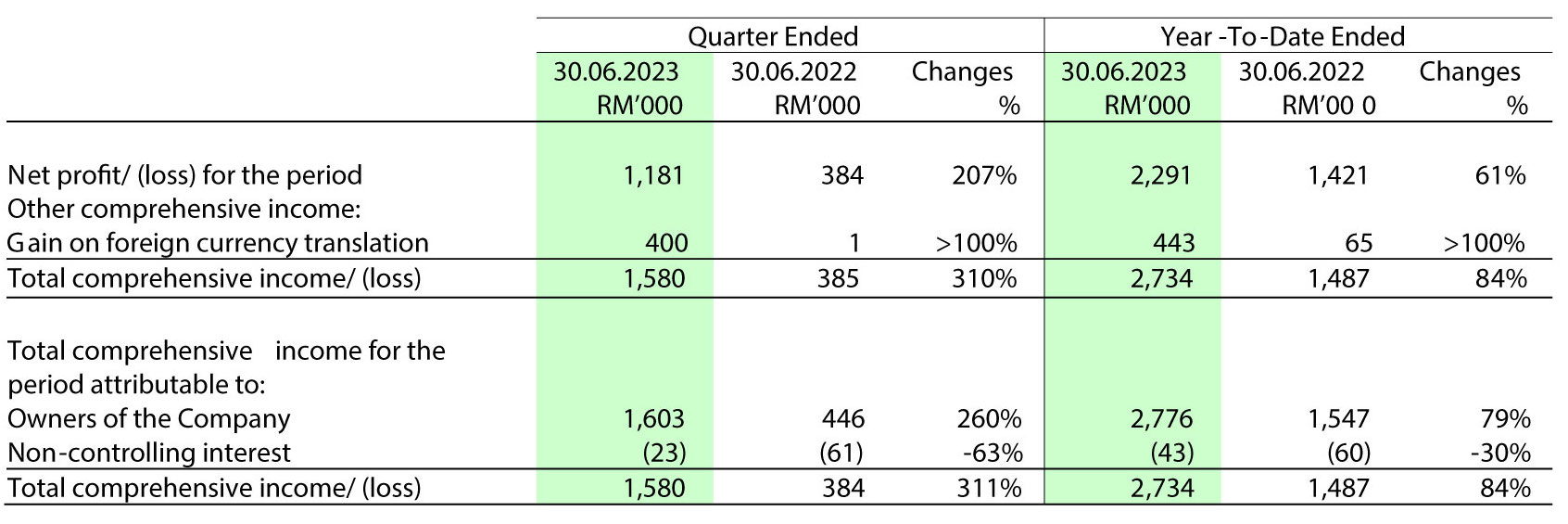

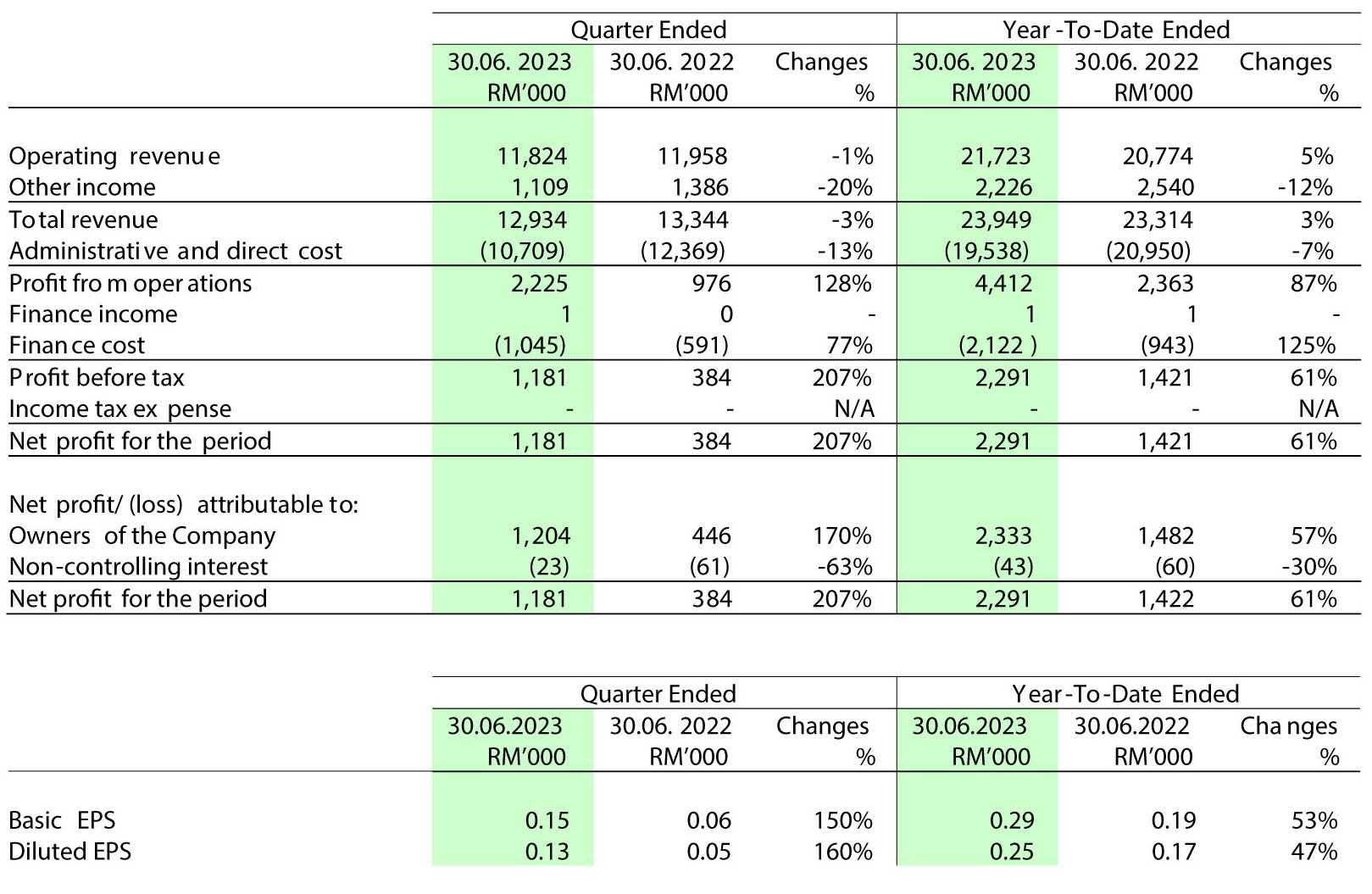

The group’s operating revenue experienced a slight 1 percent decrease, moving from RM11.96 million in the comparable period of the prior year to RM11.82 million. This change can be attributed to a combination of factors. Notably, a new revenue stream emerged from pulp and paper manufacturing, contributing RM8.76 million. Additionally, there was a significant RM1.4 million increase in revenue from the sale of semi-finished fertiliser (Fermented EFB). Furthermore, the Printing and Publishing segment demonstrated a notable 47% overall revenue increase from its printing services and book sales. Besides, there significant decrease in revenue from Property & Construction due to absence of sale of sub-divided land in GTP and Utility & Renewable Energy Division due to disposal of Osmocell in October last year.

Group net finance cost surged by 77 percent in comparison to the same quarter’s results from the previous year. This increase was primarily driven by the interest on the Bank Pembangunan loan, which in line with full disbursement of RM48.9 million borrowing completed in September 2022. Group administrative declined due to the absence of one-off professional fee expenses as well as better GP margin in the current quarter as compared to the same quarter in preceding year mitigated the lower revenue and higher net finance cost. Overall, these factors collectively contributed to a stronger group performance in the current quarter when compared to the corresponding quarter of the preceding year.

PATAMI has been reported at RM 1.20 million, marking a substantial 170 percent increase when compared to the corresponding period in the previous year. This rise has led to the elevation of EPS to 0.15 cents per share, a notable change from the 0.06 cents per share recorded during the same period in the preceding year.

The group’s operating revenue experienced a modest rise of 5 percent in the initial half of the 2023 financial year. This increment elevated the revenue from RM20.77 million in the corresponding period of the preceding year to RM21.72 million. This improvement was predominantly propelled by two divisions: the Manufacturing division, which contributed 88 percent of the group revenue, and the Printing & Publishing division, which contributed the remaining 12 percent. During the period under review, the other operating division, namely Property & Construction, as well as Utility & Renewable Energy, did not generate any revenue for the Group. As a result, there was a revenue deficit amounting to RM12.02 million, representing a shortfall of RM9.54 million and RM2.48 million correspondingly in comparison to the corresponding period in the previous year.

During this period, the group experienced a significant 125 percent increase in its net finance cost compared to the same results from the first half of the previous year. This surge was primarily due to higher interest expenses resulting from the full disbursement of the RM48.9 million loan obtained from Bank Pembangunan in September 2022. On a positive note, the group’s administrative expenses saw a modest 7 percent decrease. This was attributed to the absence of one-time charges related to professional fees linked to borrowing, as well as an improved gross profit margin for this period when compared to the same period in the previous year.

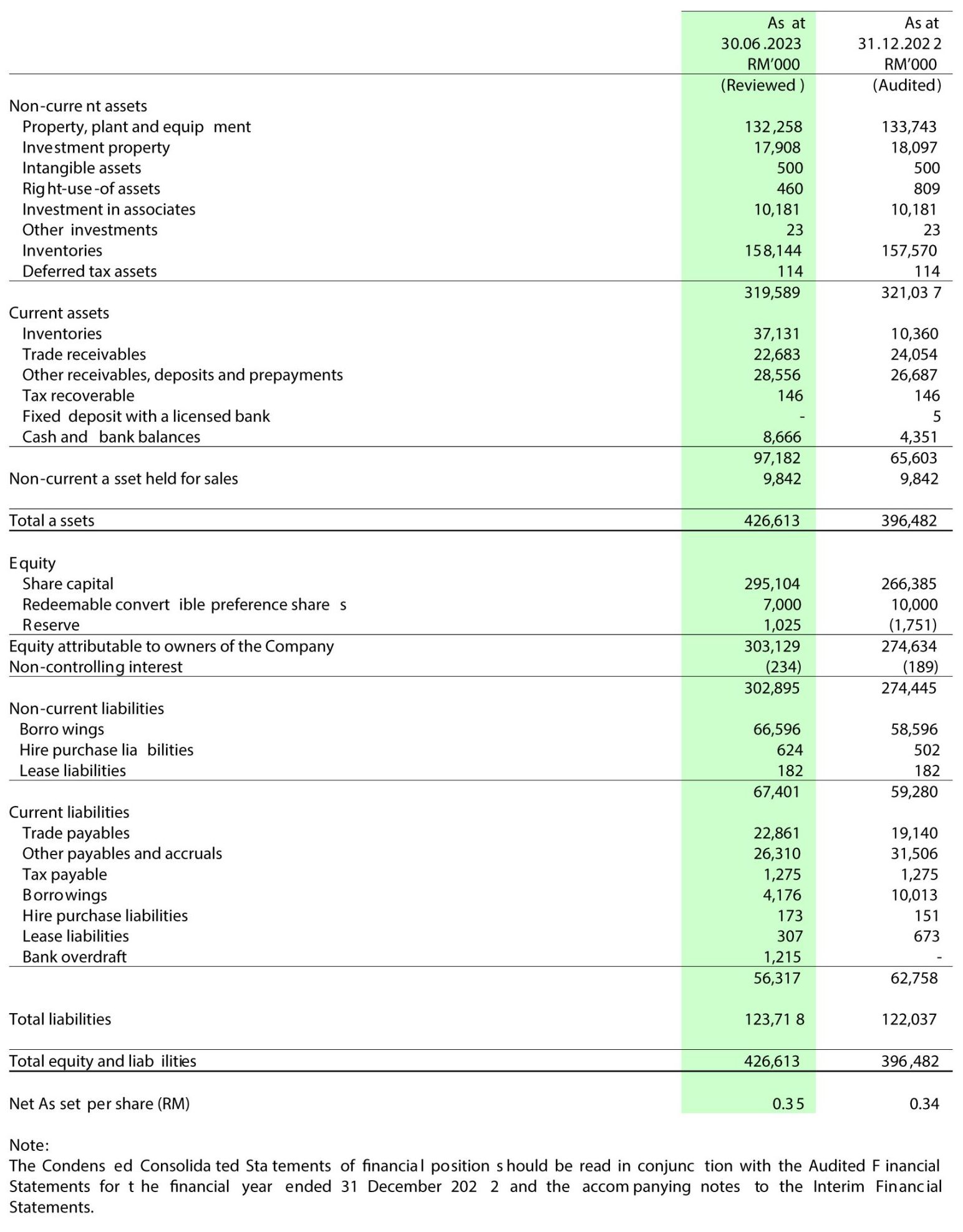

As a result of the various factors outlined earlier, the after-tax results experienced a remarkable 61 percent upswing, surging from RM1.42 million to RM2.29 million, when compared to the same period in the previous year. This enhanced after-tax performance also influenced the Profit After Tax and Minority Interest (PATAMI), which saw a substantial 57 percent increase, reaching RM2.33 million compared to the reported RM1.48 million in the corresponding period of the prior financial year. This positive result has caused a significant rise in Earnings Per Share (EPS) to 0.29 cents per share, which is a notable change from the 0.19 cents per share noted in the same period the previous year.

In the midst of the expanding digitalization trend, the Group remains resolute in its confidence in the competitive prowess of its commercial printing segment. A recently established subsidiary, Nextgreen Packaging (M) Sdn Bhd, is strategically focused on making inroads into the local box and packaging market. Simultaneously, the commercial printing and publishing segment remains dedicated to prioritizing its existing customer base. The operational entities are proactively nurturing collaborative partnerships with Bumiputera status companies to secure government printing contracts in the future.

The Group’s pulp and paper manufacturing plant, managed by Nextgreen Pulp & Paper Sdn Bhd (“NGPP”), commenced its operations in June 2022. This facility, referred to as “Phase 1A,” possesses an annual production capacity of 10,000 metric tons. Current production activities are effectively fulfilling customer orders and offering product samples to prospective clients, both domestically and internationally. The Group foresees the conclusion of additional orders from both new and established customers in the upcoming period.

As of August 16, 2023, the Group officially announced the initiation of trial run production for food-grade empty fruit bunch pulp moulding by Nextgreen Crowning Package Pulp Molding Sdn Bhd (“NGCP”). NGCP, established in July 2020 as a joint venture between NGGB and Crown Package Co. Ltd. from Japan, is dedicated to the production and distribution of pulp molding products crafted from empty fruit bunches, as well as the sale of packaging materials to Japan. The Group holds a strong belief that this venture will yield positive contributions to its overall performance in the times ahead.

In the realm of fertilizer manufacturing segment, the Group has embarked on the construction of a fertilizer production plant designed to accommodate an annual capacity of 30,000 metric tons. This plant, to be situated within GTP, will be operated by the wholly owned subsidiary Nextgreen Fertilizer Sdn Bhd (“NGFâ€). Its operations will encompass the production of solid and liquid organic fertilizer, utilizing waste from Phase 1A production as well as Fermented EFB. The construction of production plant is anticipated to be completed in Quarter 4 2023. This strategic initiative is projected to contribute to the Group’s operating revenue subsequently.

Additionally, the Group has entered into a Memorandum of Understanding (MoU) with the National Farmers Organization (NAFAS) to explore potential arrangements pertaining to fertilizer supply. A formal agreement on this collaboration is expected to be established in the near future.

During this period, the group experienced a significant 125 percent increase in its net finance cost compared to the same results from the first half of the previous year. This surge was primarily due to higher interest expenses resulting from the full disbursement of the RM48.9 million loan obtained from Bank Pembangunan in September 2022. On a positive note, the group’s administrative expenses saw a modest 7 percent decrease. This was attributed to the absence of one-time charges related to professional fees linked to borrowing, as well as an improved gross profit margin for this period when compared to the same period in the previous year.

As a result of the various factors outlined earlier, the after-tax results experienced a remarkable 61 percent upswing, surging from RM1.42 million to RM2.29 million, when compared to the same period in the previous year. This enhanced after-tax performance also influenced the Profit After Tax and Minority Interest (PATAMI), which saw a substantial 57 percent increase, reaching RM2.33 million compared to the reported RM1.48 million in the corresponding period of the prior financial year. This positive result has caused a significant rise in Earnings Per Share (EPS) to 0.29 cents per share, which is a notable change from the 0.19 cents per share noted in the same period the previous year.